By Anders Lorenzen

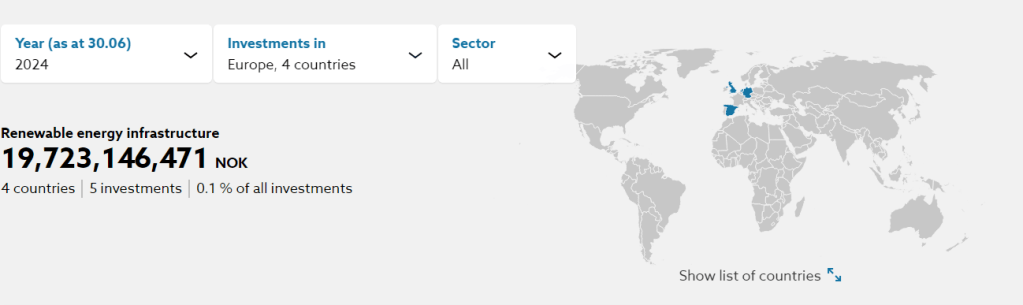

Norway’s Sovereign Wealth Fund, the Norwegian government`s pension fund, is the largest of such funds, with assets under management valued at $1.71 trillion, and has targeted large investments in renewable energy.

The Fund was established in 1990 and built on Norway’s oil and gas revenues. It has announced that it will commit $1.01 billion (€900 million) to the renewable energy investment firm, Copenhagen Infrastructure Partners (CIP).

Norges Bank Investment Management (NBIM), which manages the business, has committed the funds, which will go, to a flagship fund CI V, recently established by CIP. The firm invests in offshore wind as well as onshore wind, in solar farms, and in grid distribution and storage.

NBIM invests the revenue from the Scandinavian country’s oil and gas industry in global stocks, fixed income, real estate and renewable energy assets.

Further investment possibilities

Explaining the investment, NBIM said: “(This deal) will provide further investment possibilities and exposure to other parts of the value chain, as well as the opportunity to continue building knowledge and experience with new markets and technologies.”

CIP expects to conclude fundraising for CI V above the target fund size of €12 billion euros. According to its website, it reached its first close of €5.6 billion in capital commitments in June last year.

The investments will be split equally between the three regions of North America, Western Europe and developed countries in the Asia Pacific region, NBIM said.

Despite supporting many international climate and renewable energy projects, the Norwegian government and its oil and gas industry have not pledged to scale back oil and gas extractions. This is contrary to many of its European counterparts and is attracting criticism from climate advocates.

Discover more from A greener life, a greener world

Subscribe to get the latest posts sent to your email.

Categories: CSR, Energy, Europe, finance, investments, sustainability